marin county property tax due dates 2021

The median property tax in Marion County Indiana is 1408 per year for a home worth the median value of 122200. The City is offering a sanitary sewer 25 service fee credit for the upcoming.

115 Real Estate Infographics Use To Ignite Your Content Marketing Updated In 2021 Real Estate Infographic Real Estate Tips Getting Into Real Estate

Secured property taxes are payable in two 2 installments which are due November 1 and February 1.

. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address. 20212022 secured property tax bills will be mailed out during the month of October 2021. A form will automatically be sent to those who filed the previous year.

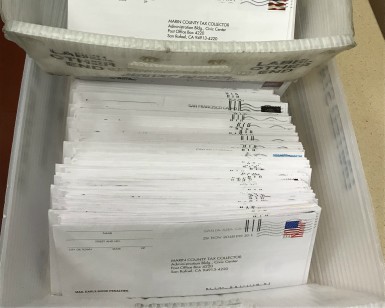

Marin Countys 2020-21 property tax bills 91184 of them was mailed to property owners September 25. SANITARY SEWER 25 SERVICE FEE CREDIT. All secured personal property taxes.

You must reapply each year to keep the exemption in effect. Last day to file a claim for postponement of property taxes. March 12 2021.

September 27 2021 at 642 pm. 10 to avoid penalty. 1 and must be paid on or before Dec.

Pay your taxes in full by November 15 or make partial payments with further installments due in. Property Taxes Due by December 10 Online or phone payments recommended by Tax Collectors Office San Rafael CA The first installment. The second installment must be paid by April 10 2021.

The second installment must be paid by April 10 2021. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. November 30 2021 Reminder.

Search Marin County Records Online - Results In Minutes. 21 rows First installment secured real property taxes due. Property Tax Payments Property tax statements are mailed before October 25 every year.

The first installment is due Nov. The sales can occur prior to January 1 but no later than April 1. Marion County collects on average 115 of a propertys assessed.

This years tax roll of 1223521178 is up 573 over last. The Marin County Department of Finance has mailed out 91854 property tax bills for. Both installments may be paid.

Ad No Stress Property Tax Appeal - Call Now For Guaranteed Tax Savings. You must file your request by May 31 2021. Penalties apply if the installments are not paid by December 10 or April 10.

Pay Property Taxes by April 12 Online or phone payments recommended by Tax Collector San. September 28 2021 at 411 pm. Comparable sales used to appraise your property must be recorded no more than 90 days after January 1.

If you are a person with a disability and require an accommodation to participate in a. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. Second installment of taxes for property assessed on the secured roll is due and payable.

The tax year runs from January 1st to December 31st. Ad Find Marin County Online Property Taxes Info From 2021. Tax bills are mailed November 1 First Installment is due December 10 Last day to pay First Installment without penalties February 1 Second Installment is due April 10 Last day to pay.

FILE BY MAY 31 2021. The first installment is due November 1st and delinquent if not paid by 5 pm. Ad No Stress Property Tax Appeal - Call Now For Guaranteed Tax Savings.

Property Tax Bills On Their Way

Community Action Marin Breaking Barriers Social Services

Marin County Mails Property Tax Bills Seeking 1 26b

Marin County Ca Property Tax Search And Records Propertyshark

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

Letter Of Appointment Of Executor Template With Sample Lettering Letter Templates Free Letter Templates

Marin County Residents Can Weigh In On How Sales Tax Revenue Should Be Spent On Parks Local News Matters

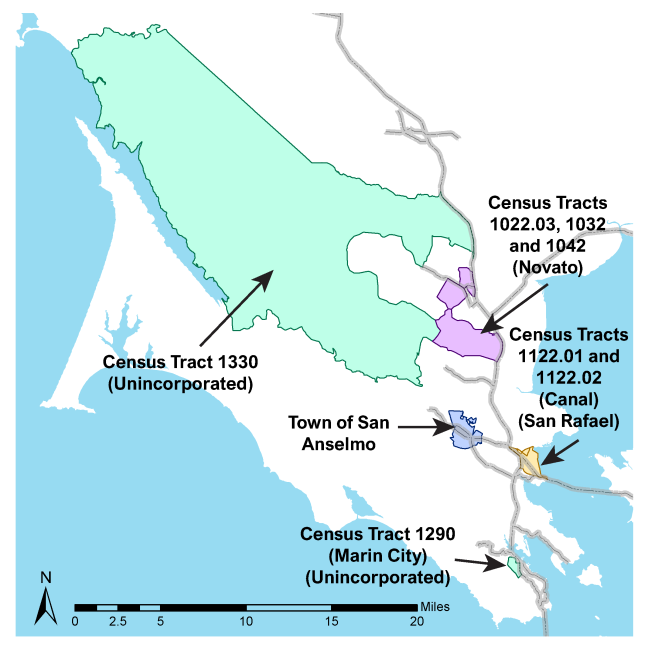

Marin County Policy Protection Map Greenbelt Alliance

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

Marin County Real Estate Marin County Ca Homes For Sale Zillow

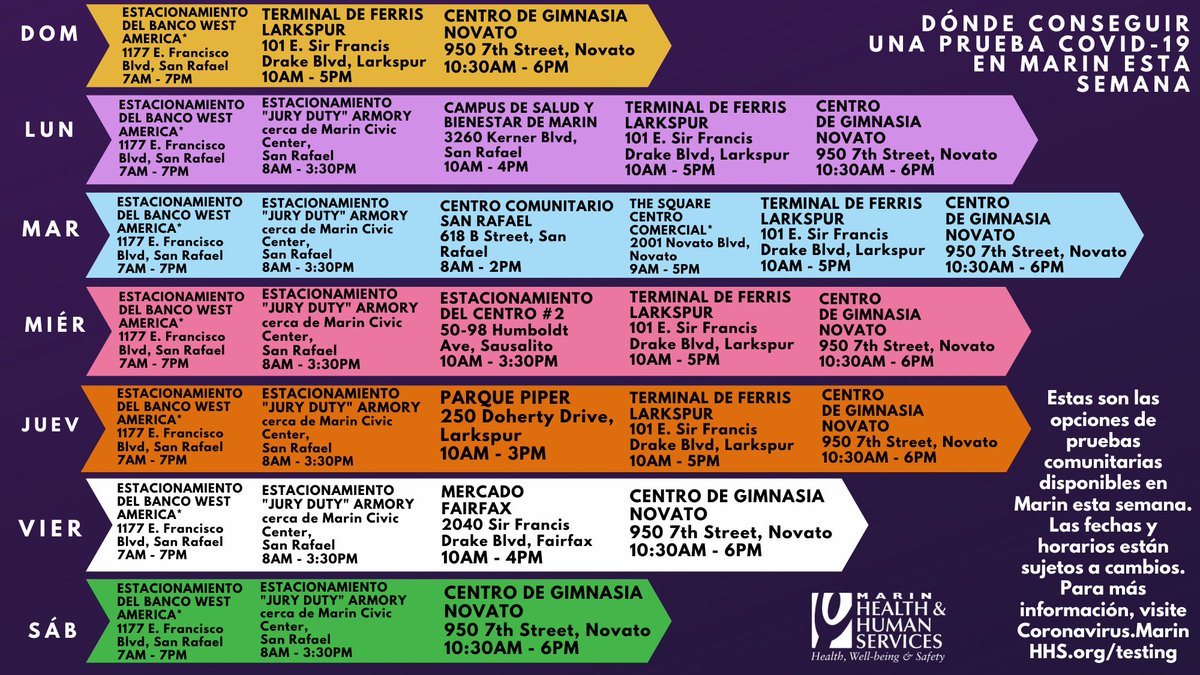

Marinhealth Humansvc Marinhhs Twitter

Covid 19 Renter Protections Community Development Agency County Of Marin

Publication 225 2016 Farmer 39 S Tax Guide Tax Guide Farm Finance Farm Business

Marin County Ca Property Tax Search And Records Propertyshark

Marin Public Works Dpwmarin Twitter