aurora co sales tax rate 2021

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates.

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

. The minimum combined 2022 sales tax rate for Arapahoe County Colorado is. Retailers are required to collect the Aurora sales tax rate of 375 on. Aurora SD Sales Tax Rate.

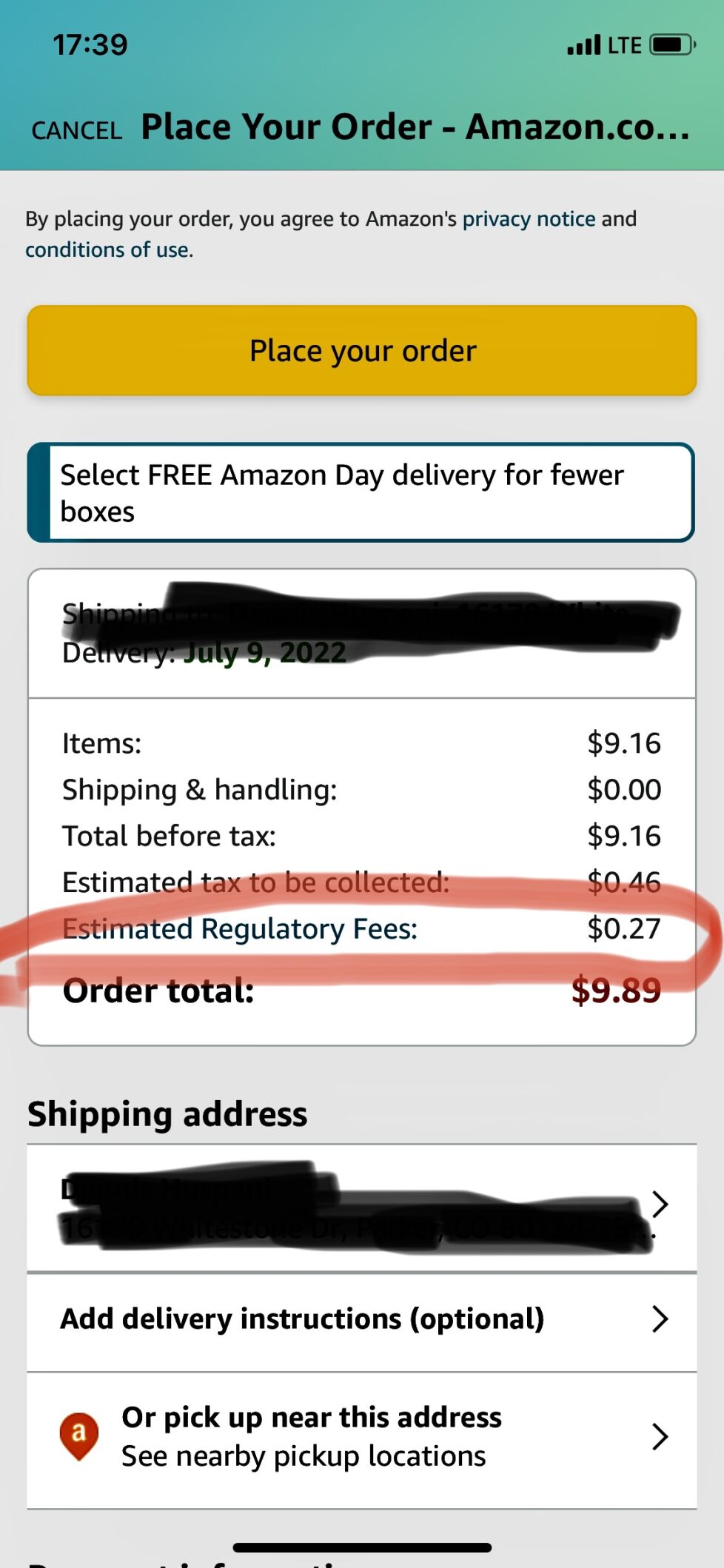

Groceries are exempt from the Aurora and Colorado state sales taxes. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. The latest sales tax rates for cities in Colorado CO state.

Effective July 1 2022. 0375 lower than the maximum sales tax in MO. What is the sales tax rate in Aurora Colorado.

Aurora collects a 56. Aurora MN Sales Tax Rate. Method to calculate Aurora sales tax in 2021.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Combined Marijuana Tax Rate Including Sales Tax Rate Excise Tax ARAPAHOE. This rate includes any state county city and local sales taxes.

The Colorado state sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction. Note that the State of Colorado has enacted the same clarification.

2022 List of Colorado Local Sales Tax Rates. Colorado has state sales. Updated 12021 Effective July 1 2006 the.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Aurora OR Sales Tax Rate. The current total local sales tax rate in Aurora CO is 8000.

The Aurora sales tax has been changed within the last year. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Aurora IN Sales Tax Rate. It was raised 000010000000000154 from 88099 to 881 in October 2022 and lowered.

The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. This rate includes any state county city and local sales taxes. Average Sales Tax With Local.

The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. This is the total of state and county sales tax rates. This clarification is effective on June 1 2021.

2020 rates included for use while preparing your income tax deduction. Rates include state county and city taxes. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax.

The Aurora Colorado sales tax is 290 the. This rate includes any state county city and local sales taxes. Aurora-RTD 290 100 010 025 375.

2020 rates included for use while preparing your income tax deduction. The 9225 sales tax rate in Aurora consists of 4225 Missouri state sales tax 25 Lawrence County sales tax and 25 Aurora tax. The December 2020 total local sales tax rate was also 8000.

Aurora Colorado 80012 3037397800 ARAPAHOE COUNTY.

Detroit S High Property Tax Burden Stands As An Obstacle To Economic Growth Citizens Research Council Of Michigan

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Colorado Sales Tax Quick Reference Guide Avalara

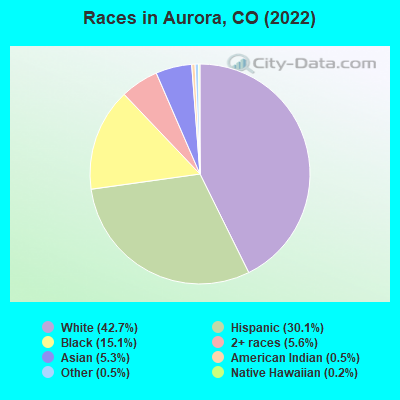

Aurora Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Aurora Colorado Sales Tax Rate Sales Taxes By City October 2022

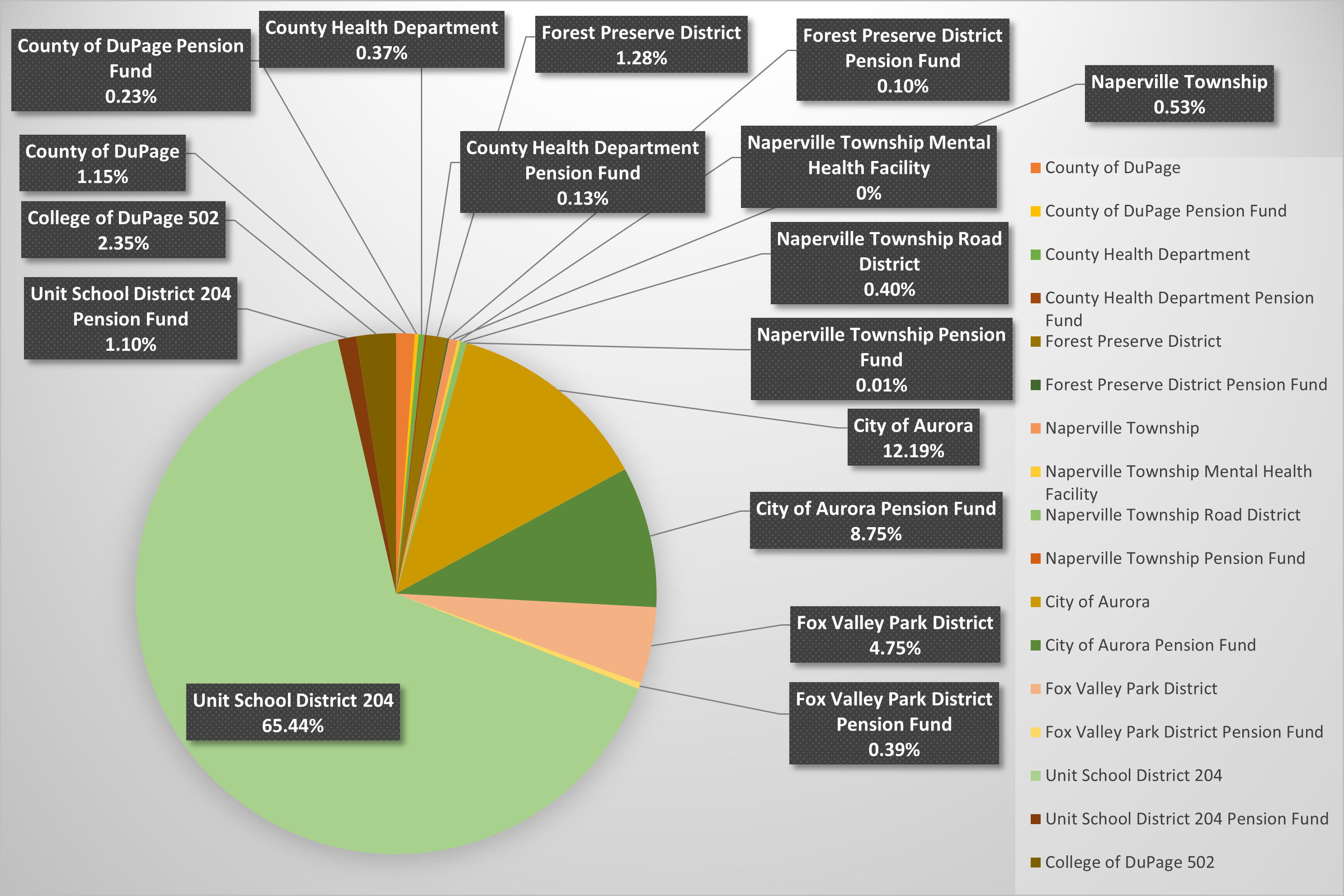

Where Do Property Taxes Go Assessor Naperville Township

Aurora Home Sales In Week Ending Sept 17 Kane County Reporter

Confusion Swirls As Colorado Imposes New Retail Delivery Fee Catching Businesses By Surprise Business Denvergazette Com

Top 10 U S Metros Where Foreclosure Filings Are On The Rise Attom

Illinois Sales Tax Rate Rates Calculator Avalara

Simplify Colorado Tax Simplify Tax

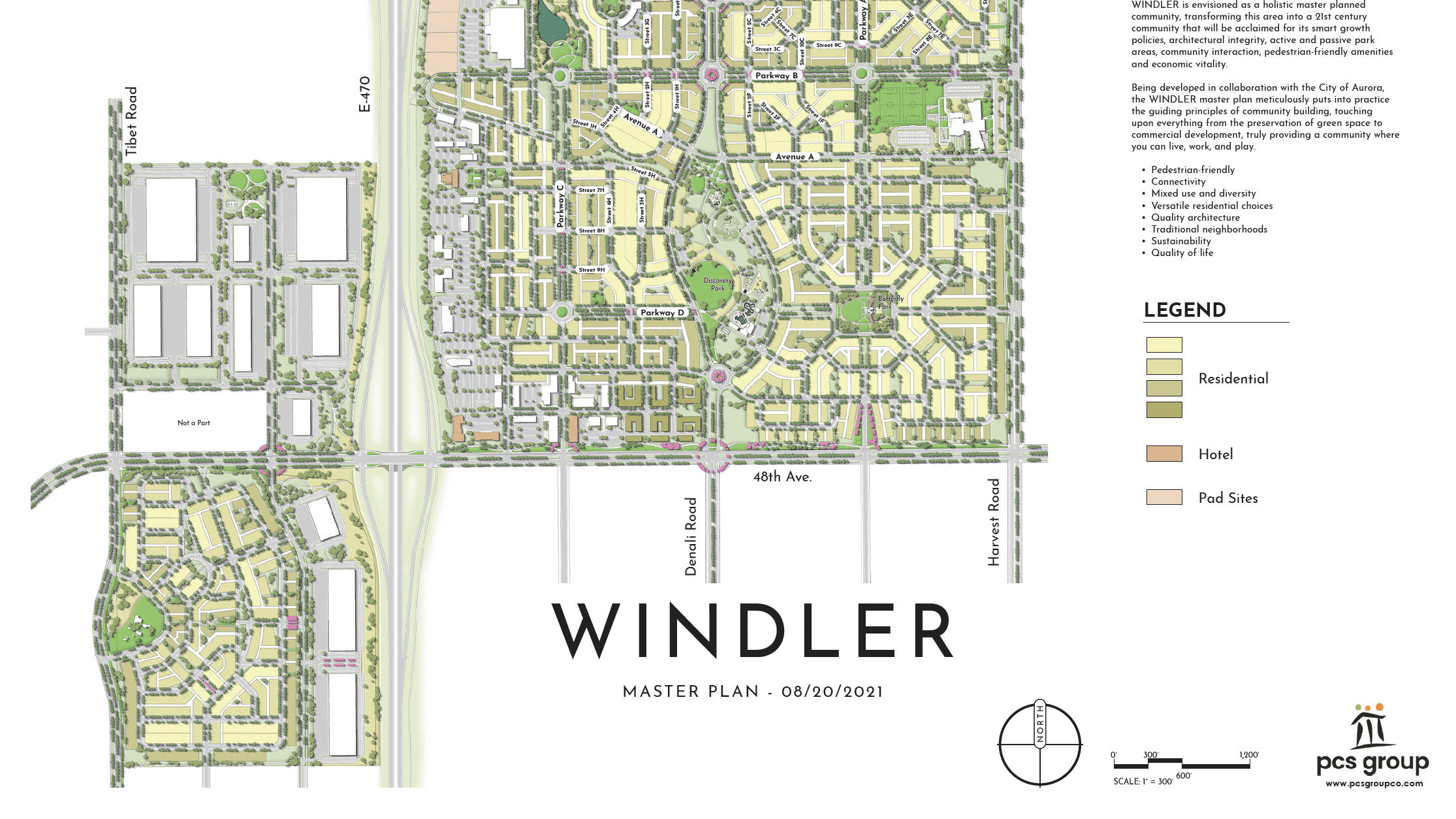

3 1b Mixed Use Development Coming To Aurora Mile High Cre

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

U S Cities With The Highest Property Taxes

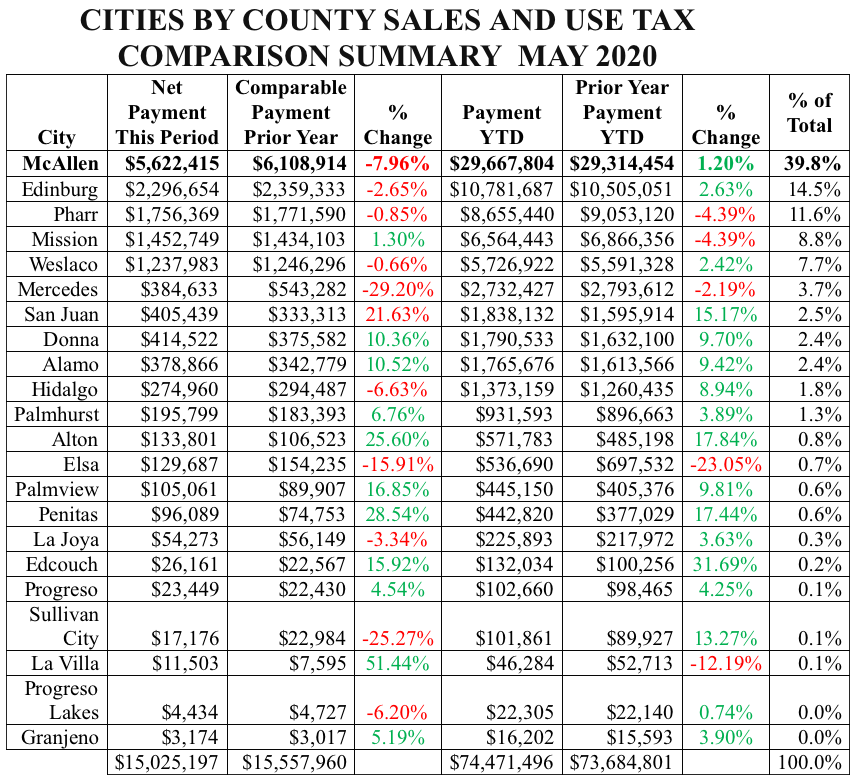

More Data Concerning May 2020 Sales Tax Info Texas Border Business

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

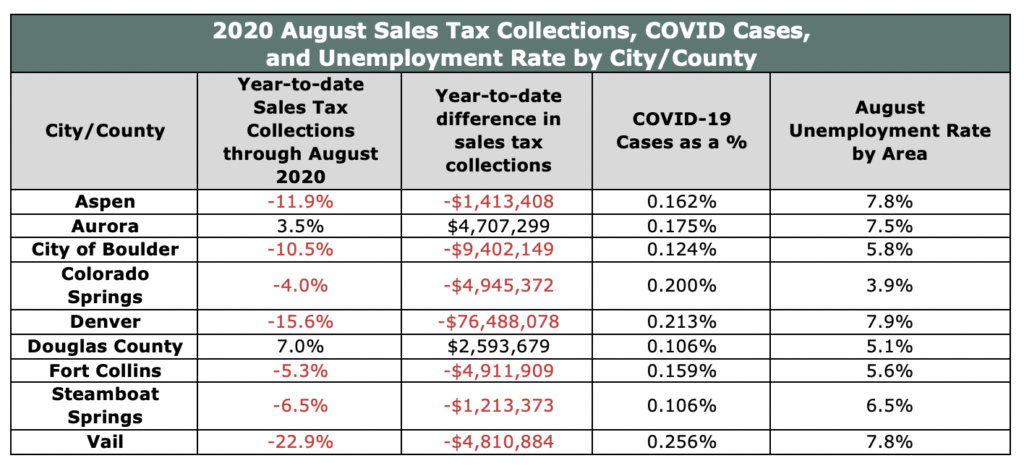

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute